- Originally published: April 20, 2022

- Last updated: January 14, 2025

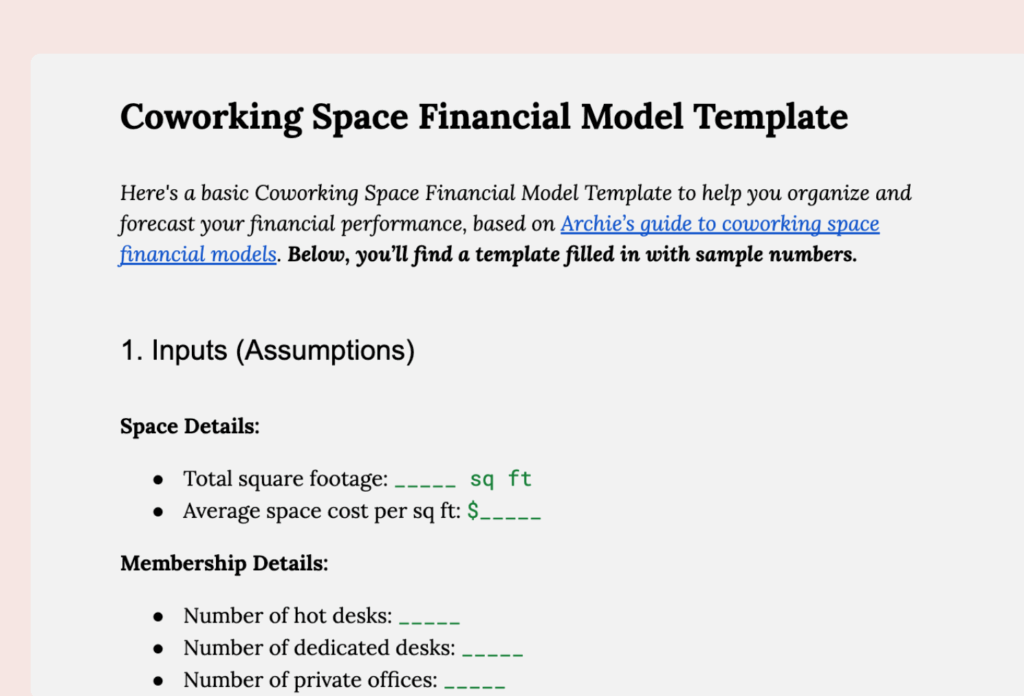

Having a solid financial model helps you keep your coworking space financially healthy. That said, building one can feel overwhelming, especially if spreadsheets aren’t your thing… Don’t worry, we’ve got you covered with a ready-made coworking space financial model template.

Guide to coworking space financial models

What's a coworking space financial model?

A financial model helps to predict how your coworking space will perform financially in the future.

It comes in handy for a couple of reasons:

- Internally, you can use it for budgeting and forecasting your finances.

- Externally, it’s useful if you’re looking to secure funding from investors or apply for a bank loan.

Typically, a coworking space financial model is built using Excel or Google Sheets. It includes your current budget and estimated projections for revenue and expenses. It’s also a great way to play around with “what if” scenarios — helping you see potential outcomes and make smarter business decisions.

💡 If you’ve already created a business plan, you might have a good sense of your coworking space’s financial situation. If not, it’s worth checking out our guide on creating a coworking space business plan first.

Financial model components

To build a coworking space financial plan, you’ll need to include three main things: costs, revenue, and operating expenses.

If your coworking space hasn’t opened yet, you’ll be working with estimated numbers for your income and expenses. These projections will help you get a sense of what to expect financially once you’re up and running.

If your space is already operational, you can use your current financial data as a starting point. This will make it easier to predict your future revenue and expenses based on what’s already happening in your business.

Whether you’re just starting a coworking business or fine-tuning an existing space, this financial model is key to planning ahead and staying on track.

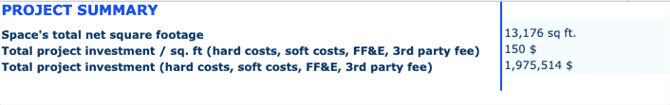

Project summary

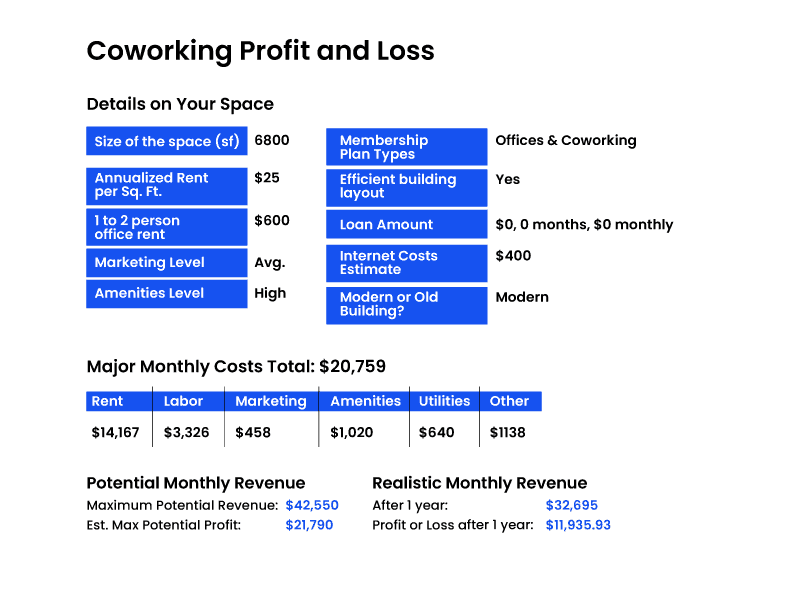

When building a financial model for your coworking space, the project summary is where you lay out the key details at a glance. Think of it as the starting point that gives you (and anyone else looking at your model) a quick overview.

Here’s what to include:

- Total Usable Space: How much of your space is available for coworking, measured in square feet.

- Cost Per Square Foot: How much money you’re spending to create each square foot of usable space.

- Total Investment: The total amount you’re investing in your coworking space project.

This section gives a big-picture view of your project’s size and overall cost. For example:

Sample Project Summary

- Usable Space: 5,000 sq. ft.

- Cost Per Square Foot: $150

- Total Investment: $750,000

💡 Even if you don’t have a building yet, it’s a good idea to sketch out a layout for your coworking space. Start by picking an “ideal” size you’d like to work with, like 14,000 square feet, as a baseline. If you find a building that’s a bit smaller or bigger, you can easily adjust your model by assigning percentages to how each area will be used.

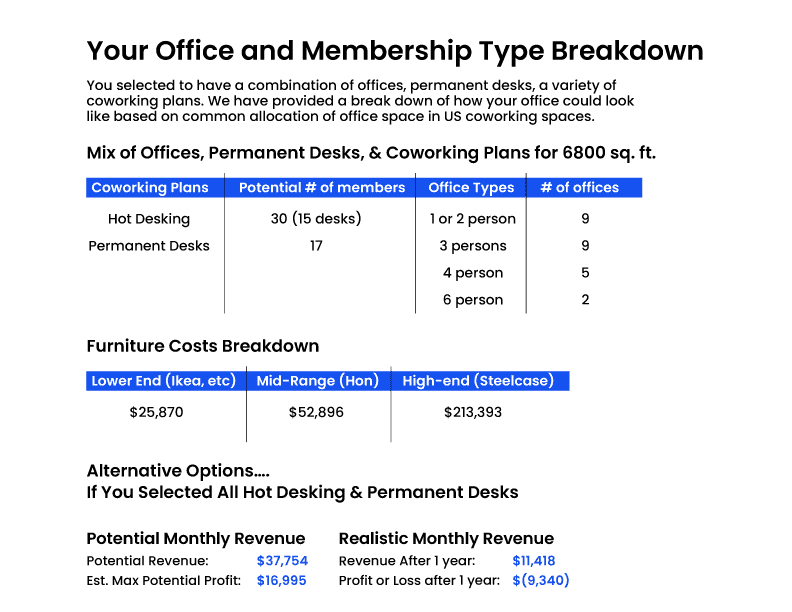

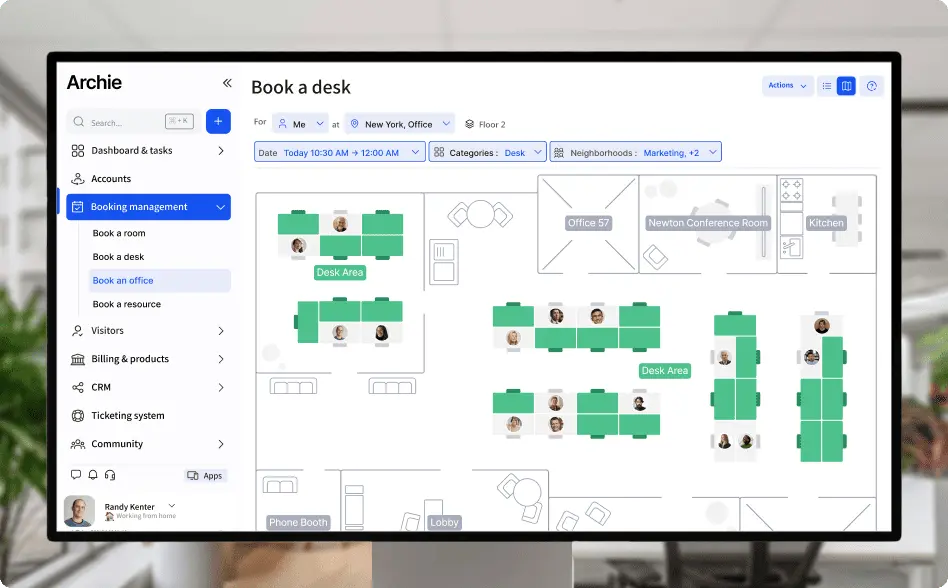

Next, specify how much space is allocated for different areas, like:

- Workspace: Private offices, dedicated desks, and hot desks

- Ancillary areas: Meeting rooms, phone booths, storage, breakout spaces

- Common spaces: Events areas, kitchens, café/bar/restaurant, and reception

- Utilities: IT and printing, circulation, and any extras like podcast booths or nap pods

While it’s tempting to squeeze in as many desks as possible, overloading the space can make it feel cramped and less appealing. Thankfully, renting desks is not the only way that coworking spaces can generate revenue:

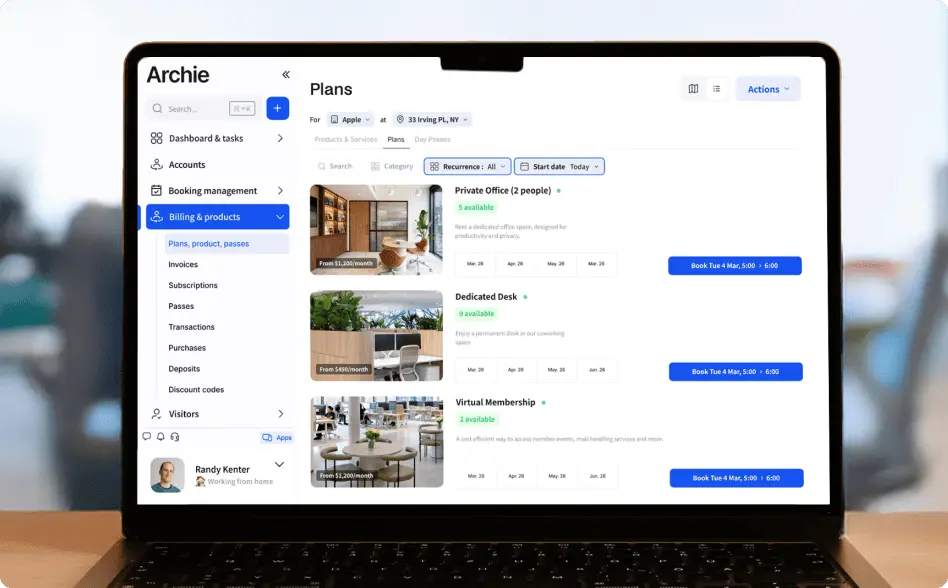

Revenue

Your coworking space will likely make money from more than one source. The two biggest revenue streams are typically membership plans and office leasing. While your coworking space might also profit from hosting events or renting out conference rooms, these income sources tend to be less consistent and make up a smaller part of your total revenue, so it’s best not to rely too heavily on them in your financial model.

If you’re creating the model for internal use, you don’t need to break down every revenue stream in detail. However, if you’re using it to raise funds or apply for a loan, it’s a good idea to include a detailed breakdown of your income sources.

To calculate your revenue, multiply the average revenue per member by the number of members you expect to have. For example, if the average member pays $200 per month and you project 50 members in your first year, your total revenue would be:

($200 x 12 months) x 50 members = $120,000/year.

Remember, your average revenue per member is usually calculated monthly, so make sure to multiply it by 12 to get the yearly amount before factoring in the number of members.

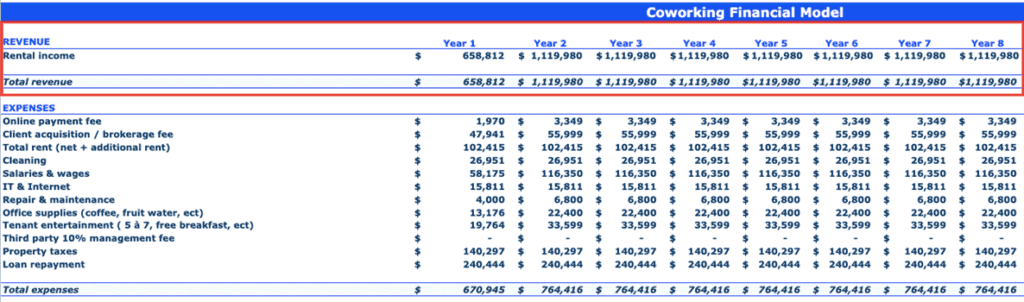

Here’s an example of how the revenue section in your financial model might look:

Expenses

Your financial model should have a section that breaks down your expenses in detail. These ongoing costs, called Operating Costs (OpEx), cover everything you need to run your coworking space. It’s helpful to separate property costs from business operating costs when setting this up, for example:

💰 Property costs

- Rent (if you’re leasing the space)

- Business rates or council tax

- Service charges (fees from your landlord)

💰 Operating costs

- Staffing (often the biggest cost after rent)

- Utilities (electricity, water, heating/cooling)

- Internet

- Cleaning and maintenance

- Marketing

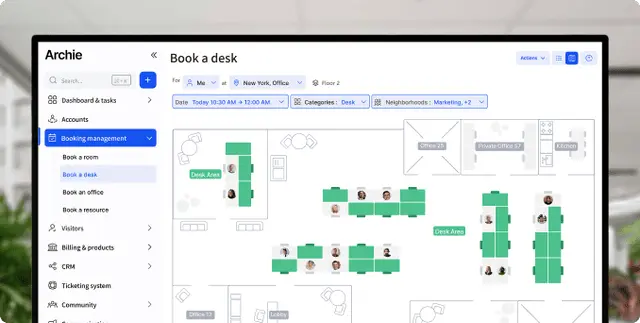

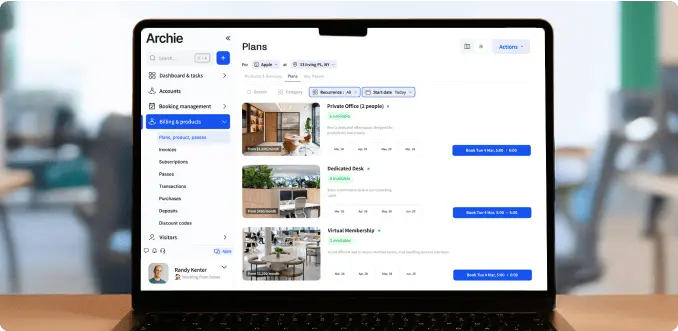

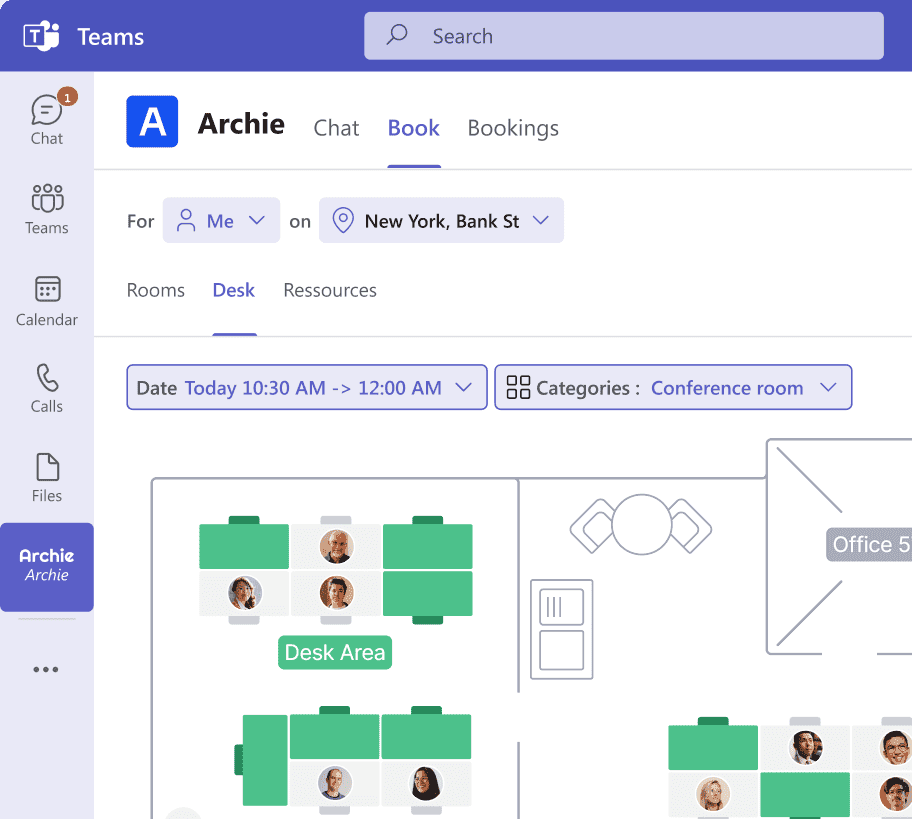

- Software (coworking management software plus the integrated tech stack)

- Events

- Printing and office supplies

- Accounting and administrative costs

- Repairs and unexpected expenses

Here’s an example of what the expenses section in your coworking space financial model might look like:

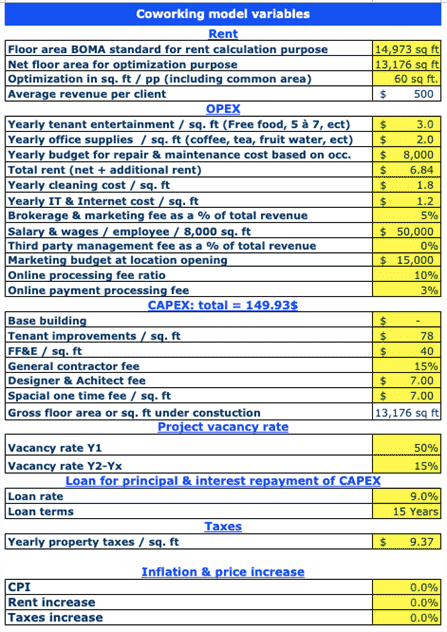

Coworking space financial model variables

This section of your financial model is where you enter either your current numbers or your projections, depending on whether your coworking space is already up and running or still in the planning phase.

The model uses your operating expenses (OpEx) and total income to calculate your profit forecast and even determine your break-even point. By filling in the numbers for each line, the built-in formulas will automatically create forecasts. This makes it easy to experiment with different scenarios by adjusting the numbers to see how they impact your results.

Here’s an example of what the project variables section in your coworking space financial plan might look like:

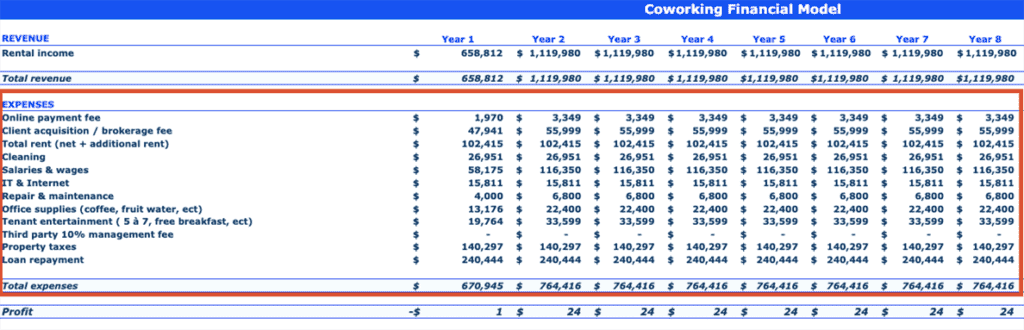

Calculating profit and loss

After you’ve worked out your income, property costs (COS), and operating expenses (OpEx), you can calculate your profit like this:

(Revenue) – (COS) – (OpEx) = Profit

Most coworking space financial plans look ahead about 5–15 years, depending on your goals. Don’t forget to budget for upgrades or renovations every 5–7 years, as these will affect your long-term finances.

Using your financial model

Your coworking space financial model is a powerful tool for understanding the financial health of your business. It helps you see if your pricing is too low and figure out how much revenue you need to cover your costs, repay loans, and stay afloat.

Download our free coworking space financial model template and start planning your path to profitability.

One big tip: don’t get too optimistic with your projections. Instead, test out your worst-case revenue scenarios to ensure you can at least break even. Running these tests gives you a clear view of where you can trim costs without hurting your operations if needed.

You should test at least three scenarios:

- Best-case scenario – where your revenue exceeds expectations.

- Break-even scenario – where you cover costs but don’t make a profit.

- Worst-case scenario – where your space is losing money.

About 46% of coworking spaces become profitable within their first year, but most take around two years to break even. Still, not every space makes it — nearly half struggle to turn a profit, and 25% report losses, according to the Global Coworking Survey.

The most successful coworking spaces keep their occupancy high, use space wisely, and offer flexible membership options:

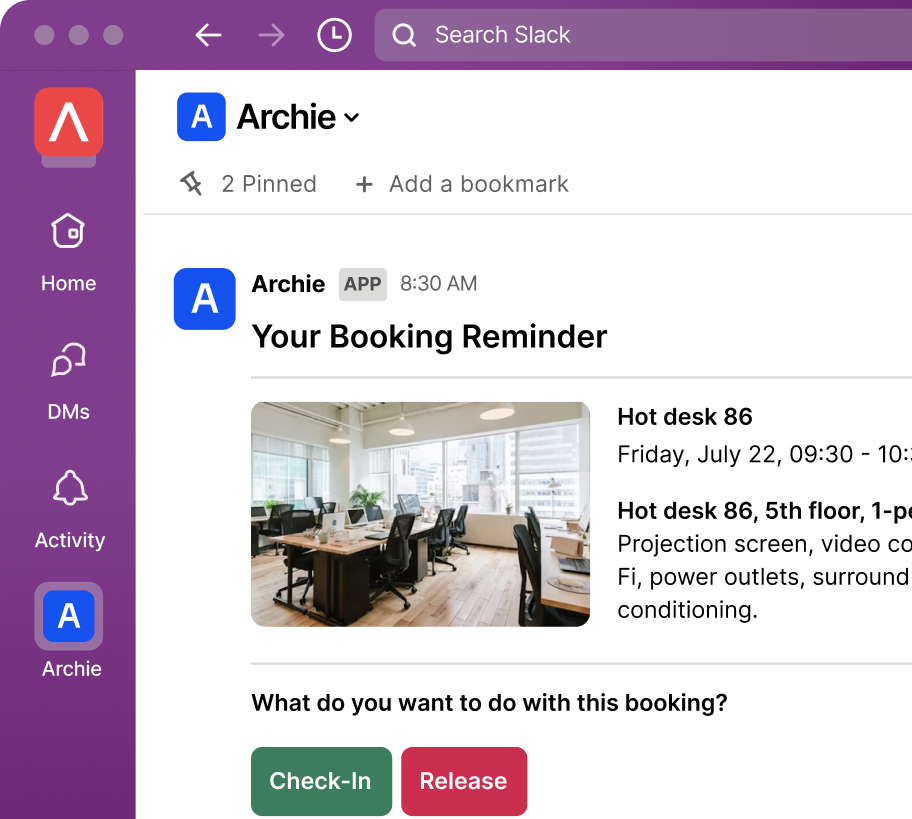

When I first opened my coworking space, I focused on long-term members and office sales. After a few months, I realized that this traditional focus was limiting the number of people I could convert, and I was missing out on a large market segment that was active in my region. Not wanting to miss out on potential revenue, I decided to diversify my service offerings and target a broader audience. I saw the untapped potential of non-members and the rising demand for flexible options for room bookings and day pass users. I developed a public online signup and booking page, making it effortless for anyone to discover and access the coworking space. I also integrated self-serve automations for both bookings and day passes to cut down on the work that would be required to onboard and serve these bookings. The ease of online bookings attracted new users, significantly driving up utilization rates and diversifying revenue streams.

Regularly review and adjust your pricing, ideally once a year, and always work toward balancing your income and expenses to stay profitable. Good luck!

![Building a Coworking Space Financial Model [Free Template] A bright coworking space with desks and tan-and-black office chairs.](https://archieapp.co/blog/wp-content/uploads/2022/05/Coworking-Space-Financial-Model-Cover-image.jpg)

![38 Top Coworking Conferences and Events of 2026 [Confirmed] Top coworking conferences - cover image.](https://archieapp.co/blog/wp-content/uploads/2023/10/coworking-400x400.jpeg)