Trying to stay updated on coworking industry stats? Smart move. Knowing how coworking spaces are evolving can help you see where your coworking business stands.

The challenge? There’s a lot of information out there. A quick Google search for “coworking statistics” pulls up over 6 million results in less than a second. Sounds helpful, but…

Here’s the problem: A lot of the data floating around is outdated. Some reports still use numbers from five years ago! Given how much the coworking industry has changed in the last few years, relying on old data can give you the wrong picture of where the industry is headed and how you should adapt.

Instead of sorting through endless reports, we’ve gathered the most important coworking stats and trends so you don’t have to. Let’s explore what they mean for your coworking business.

Guide to coworking statistics

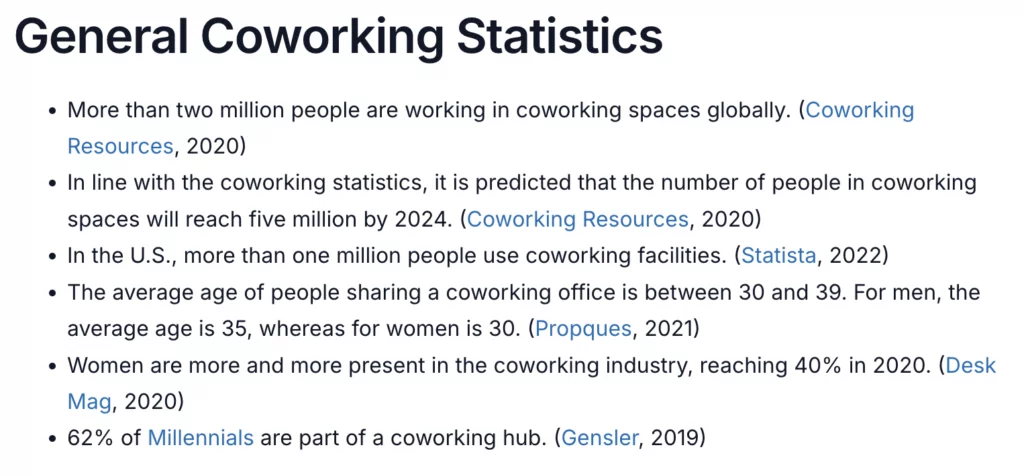

Key coworking industry statistics

- The global coworking spaces market was valued at $22.01 billion in 2024 and Market Research Future projects it could reach $93.68 billion by 2035, growing at about 14.07% CAGR (2025 to 2035).

- Flexible space demand is also being pulled by companies, not just freelancers. In a 2024 WeWork survey, 59% of companies that plan to increase workspace in the next two years said they are choosing flexible space over traditional offices.

- CoworkingCafe’s U.S. Coworking Industry Report (Q3 2025) puts the national median starting price at $225 per month for memberships (open workspace plus dedicated desk) and $30 for a day pass.

- In the same report, CoworkingCafe also lists $45 per hour as the national median for meeting rooms and about $159 per month for virtual offices, which helps round out the “typical” price package many operators sell.

- CoworkingCafe reports that the US had 8,420 coworking locations covering roughly 152 million square feet in Q3 2025, and that coworking is still only about 2.1% of US office space.

- On the operator scale, CoworkingCafe notes that Regus is the largest US operator, with roughly 1,185 locations nationwide (and 950 across the top 50 markets).

- Deskmag’s 2025 survey reporting suggests profitability improved compared with earlier years: 54% of coworking businesses were profitable, and 18% reported losses over the previous 12 months.

The current state of the coworking industry — statistics

Coworking is one of the fastest-growing parts of the office world right now. The global coworking and flexible office market is currently worth around $21 billion, and it’s expected to nearly triple by the early 2030s. In fact, coworking experts predict it will grow to an incredible $82.12 billion by 2034, with a strong yearly growth rate of 14.1%. Other studies estimate the market will be worth $51.42 billion in 2029 and $40.47 billion by 2030 (growing at 15.7% per year).

Even with economic ups and downs, demand for coworking is still strong around the globe. By the end of 2024, there were about 42,000 coworking spaces worldwide, and the number kept climbing in 2025.

What’s exciting is that coworking still makes up only a small slice of all office space globally. That means there’s a lot more room to grow in the years ahead as more people and businesses choose flexibility over traditional office leases.

Why are coworking spaces growing?

Several key factors drive the rise of coworking spaces:

- More freelancers and startups: The number of independent workers is growing worldwide. Many freelancers and startups prefer coworking spaces because they offer affordable, flexible office solutions without long-term contracts.

- Hybrid and remote work boom: Since COVID-19, many companies have adopted hybrid work models, allowing employees to split their time between home and the office. Businesses are turning to coworking spaces instead of leasing traditional office spaces for flexibility, cost savings, and access to high-quality work environments.

- Big companies are joining in: It’s not just startups — large corporations are also using coworking spaces for their remote teams, satellite offices, and short-term projects.

- Cost savings: Renting an office is expensive, especially in big cities. Coworking spaces provide a cheaper alternative with different amenities like WiFi, meeting rooms, and printing services.

- Government support: Some governments encourage coworking spaces as a way to support entrepreneurs and small businesses.

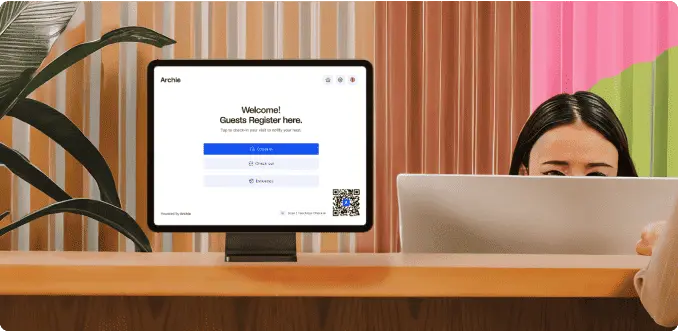

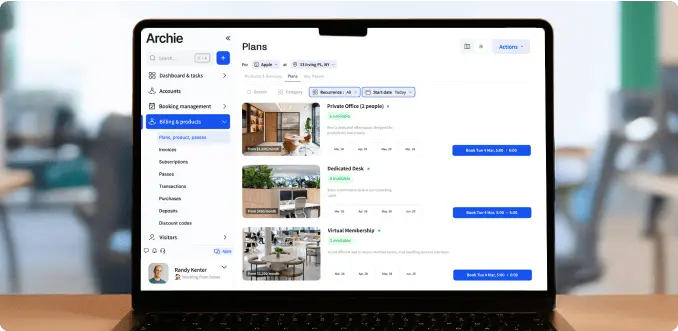

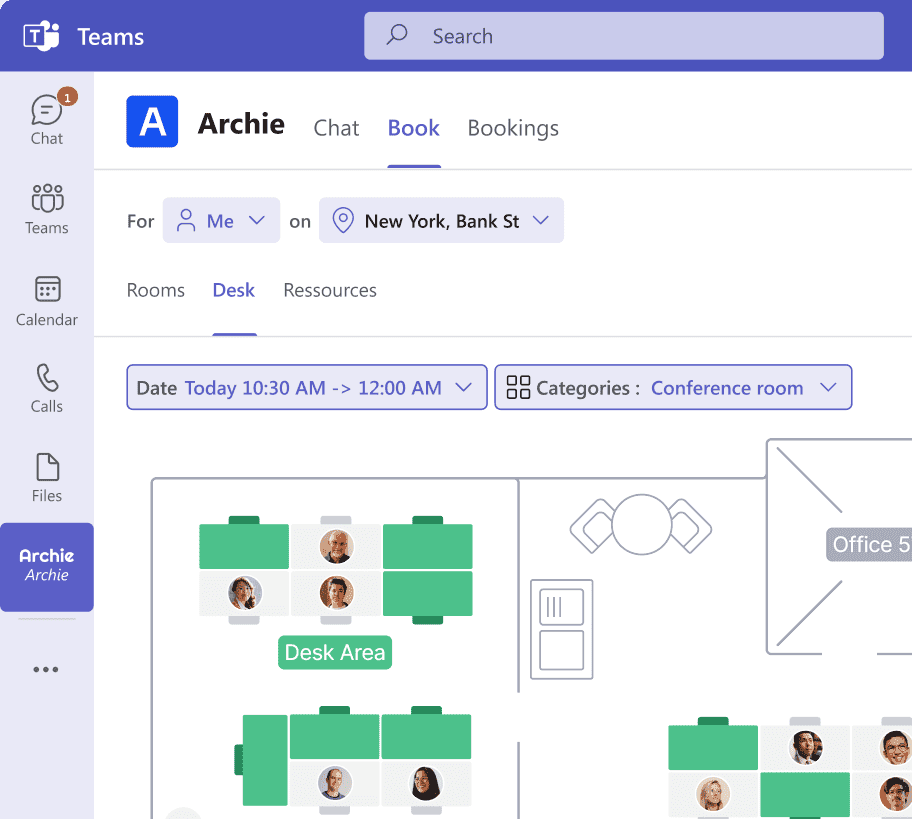

- Technology upgrades: Many coworking spaces are investing in smart technology, including coworking management tools, automated access control, and visitor tracking systems, which automate daily operations and help run spaces efficiently.

Stats on key players in the coworking industry

The coworking industry is dominated by the largest coworking brands, each offering unique office solutions. Globally, some of the biggest coworking providers include:

- WeWork – One of the most well-known coworking brands worldwide.

- International Workplace Group (IWG) – Parent company of Regus and Spaces.

- Impact Hub – Focuses on social impact and innovation.

- The Executive Centre – Premium coworking spaces for professionals.

- Newmark – A growing competitor in flexible office spaces.

- Techspace Group Ltd. – Provides coworking solutions for tech companies.

Regus, owned by International Workplace Group (IWG), remains the largest coworking operator, with 1,018 locations in the US. Other fast-growing coworking brands include Industrious, which grew by 13% in top US markets, and Spaces, which expanded by 10% in the last quarter of 2024.

While some brands are expanding, others are facing challenges. WeWork, once a major coworking leader, saw a slight decline (3%) but still operates 148 locations in the US. The coworking market is competitive, and brands must continue innovating to stay ahead.

What are the demographics of coworking spaces?

While there hasn’t been a ton of new data recently, some key trends still hold true. The average coworking member is around 36 years old, and Millennials (those aged roughly 27 to 42) make up the majority, about 61%. Women now make up nearly half of coworking users, with their share steadily growing over time. On the education side, around 80% of members have a college degree, though that number is slowly going down as coworking becomes more inclusive and draws in younger workers, creatives, and professionals from all walks of life.

Who’s using coworking spaces, and why?

Coworking spaces attract a diverse mix of professionals, including:

- Freelancers – Independent workers who need a professional workspace without high costs.

- Startups & small businesses – New companies that need an affordable, flexible office and networking opportunities.

- Corporations – Large companies using coworking spaces for remote teams, client meetings, and temporary offices.

- Remote workers – Employees looking for a workspace that offers more structure and fewer distractions than working from home.

The numbers back this up. In 2023, corporate teams made up 27.6% of the coworking market, and the trend is growing. A recent WeWork survey found that most companies, regardless of their work model, plan to expand office space in the next two years, and nearly 60% prefer coworking spaces over traditional leases. Why? Because businesses are rethinking how they work, and coworking offers the flexibility, cost savings, and speed they need.

With economic uncertainty and rising operating costs, many businesses are scaling back traditional expansion plans and focusing on smarter, more agile growth. Coworking fits this new strategy perfectly, offering office space without the long-term commitment.

As for who’s investing the most in coworking, leading the charge are the IT and tech industries (50%), financial services (50%), construction and energy sectors (43% each), and business services (30%).

But coworking isn’t just for businesses. The number of independent workers using coworking spaces is expected to grow significantly from 2024 to 2030. Many freelancers find it hard to work from home due to distractions or isolation, so coworking spaces offer a productive environment with social interaction and networking opportunities. Speaking of…

The social side of coworking

Coworking spaces offer more than just a place to work; they create an environment that improves productivity while fostering social connections. Many feature amenities like yoga rooms, meditation areas, and quiet zones for breaks, promoting a healthier work-life balance. Some even provide childcare and wellness programs.

However, coworking spaces aren’t always equally accessible. Some high-end locations for coworking spaces come with expensive memberships, making them available only to certain groups. This has raised concerns about coworking spaces contributing to gentrification, as they often replace traditional offices and cater to wealthier professionals.

That said, the best coworking spaces can also bring people from different industries and backgrounds together. Many workers build strong friendships and business connections in these spaces, while others simply enjoy the flexibility of working around others without too much interaction.

Regional coworking statistics and market trends

Coworking spaces are expanding rapidly worldwide, driven by the rise of remote and hybrid work models. The coworking industry is particularly strong in North America, Europe, and Asia-Pacific, with notable growth in emerging markets across Latin America, the Middle East, and Africa. Each region has its unique trends, pricing, and challenges, shaping the coworking industry in different ways.

North America: The largest and most developed market

North America continues to lead the global coworking scene, with the US firmly in the driver’s seat. However…

The big story is that the industry is still growing, but it is doing it in a more careful, sustainable way. Instead of racing to open as many locations as possible, many operators are focusing on stronger locations, clearer pricing, and space layouts that work better for hybrid teams and become more profitable.

Here’s what that stability looks like in the latest snapshot at the end of 2025:

- Coworking reached 8,420 locations across the US, with total inventory at just over 152 million square feet.

- Even with that growth, coworking is still only about 2.1% of total office space, so there is plenty of room to expand.

- Prices look steady: the national median is about $225/month for memberships and $30 for day passes.

- The average coworking location is now around 18,000 square feet, and many big-city sites are much larger, often built to support private offices, meeting rooms, and enterprise teams.

Large players like Regus and HQ are gaining share, but they’re also trimming weaker centers and doubling down on hubs that have strong demand and healthy margins. That shift favors quality over quantity: better amenities, smarter layouts, and services that drive repeat use — while letting go of locations that never quite clicked.

Europe: Strong demand and steady expansion

Coworking continues to grow steadily across Europe, with the UK and Germany leading the way.

As of Q3 2025, the region has 4,315 coworking spaces in total, which makes it one of the most connected coworking markets globally. The UK accounts for 4,048 spaces, while Ireland adds 267. Even with broad coverage across many cities, supply is still strongly anchored in the biggest urban hubs.

In the UK, Greater London is the clear centre of gravity with 1,191 coworking spaces, which is a large share of the country’s total. After London, the next biggest hubs are:

- Manchester (120) as the leading regional market

- Glasgow (68) as Scotland’s top hub

- Birmingham (67) close behind

In Ireland, Dublin is the main anchor with 126 coworking spaces, which is close to half of all locations in the country. The mix of startups, global employers, and remote workers keeps Dublin at the heart of Ireland’s flexible office ecosystem.

Not surprisingly, demand for flexible workspaces is especially strong in Central London. Companies are signing bigger deals, and many are now using flex spaces as their main offices.

It’s not just startups either. Big players in banking, energy, and manufacturing are getting on board too. Spaces that offer a good mix of desks and shared areas are doing well, while those with too many meeting rooms risk losing money due to underused space.

In Germany, coworking is also gaining ground. Large spaces (over 500 sqm) are doing particularly well, with about 75% occupancy. However, small spaces are still struggling to stay full. While event and meeting rooms are in high demand again, profitability remains a challenge. Only 20% of coworking spaces in Germany were profitable in 2023, while 42% just covered their costs. The main challenges include high rent and energy costs, which are particularly hard for small coworking spaces that fear losing members if they raise prices.

Asia-Pacific: The fastest-growing market

The Asia-Pacific region is quickly becoming the hottest spot for coworking growth. Countries like India, China, Japan, and Australia are leading the way, thanks to the rising demand for flexible workspaces and the ongoing shift to hybrid work.

India is especially exciting right now, as it’s turning into a major coworking hub, with strong government support for startups and small businesses. China and Japan already have well-developed coworking scenes in big cities like Shanghai, Beijing, Tokyo, and Osaka. Australia is also growing steadily, with Sydney and Melbourne at the center of the action.

In 2023, the Asia-Pacific coworking market was worth about $3.09 billion. By 2030, it’s expected to reach $11.82 billion, growing at a fast pace of around 21% per year. That’s much faster than the global average, showing just how strong demand is in this part of the world. While North America is still the largest coworking market overall, Asia-Pacific is catching up quickly thanks to its rapid expansion and growing appetite for flexible office solutions.

Latin America: Steady growth and increased adoption

Latin America’s coworking industry is growing steadily, with Brazil leading the market. Mexico and Argentina are also seeing increased adoption of coworking, particularly among startups and small businesses looking for cost-effective office solutions.

Middle East and Africa: Emerging markets with growth potential

The Middle East and Africa are emerging coworking markets, with Dubai, Riyadh, and Johannesburg leading the way. Many coworking spaces in these regions focus on premium office setups for corporate clients and support local entrepreneurs and startups. The United Arab Emirates (UAE) has seen significant coworking expansion thanks to government incentives for flexible workspaces.

Coworking space profitability

A global survey from Deskmag suggested that coworking spaces started 2025 in a fairly healthy place. Coworking operators said that most spaces gained more members than they lost. When membership went up, revenue usually went up too. Many operators also said profits improved. However, it was not positive for everyone, and about one in six operators said their profitability went down.

Profitability is higher in major cities

Profitability was much stronger in major cities. Over the last 12 months in the survey, 54% of coworking businesses were profitable, and 18% reported losses. Location made a big difference: in cities with more than 1 million residents, nearly two-thirds of spaces were profitable. In towns with fewer than 20,000 people, only about 1 in 5 operators reported a profit, although about half at least broke even. This helps explain why coworking can look like a strong business in big metros, while smaller towns can feel like a tougher environment.

Occupancy is rising, and meeting space is in demand

Occupancy and demand were also improving, especially for meeting space. Global average occupancy reached 68% at the start of 2025, and it was well above 70% in major cities. Meeting spaces were one of the most in-demand offerings worldwide, and about half of operators also reported strong demand for team offices and single-person offices. The mix changes by location too: in cities, team offices and meeting rooms are a strong combination, while in rural areas, demand for event space is often higher, and demand for team offices can be much weaker.

At the same time, however:

Space per desk is rising, and it changes what “good layout” means

Deskmag’s 2025 survey results suggest that a “typical” coworking space has around 90 desks and about 1,200 m² of space, but most spaces do not match that exact profile.

A helpful benchmark here is space per desk, which Deskmag calculates by dividing total area by the number of desks. The average is now about 14.4 m² per desk (155 ft²), and Deskmag says this is well above pre-pandemic levels. That does not mean every space is getting emptier. It often means the space is being used differently.

Offerings matter more than desk density when it comes to profit

One of the most practical takeaways is that packing in desks is not a reliable path to profitability. Deskmag is pretty direct here: desk density on its own has little impact on profitability, and what matters more is the offering mix and the layout. They also note that the spaces that show up as frequently unprofitable are often the ones with extreme desk density, and these are typically very small coworking spaces.

In other words, success is less about “how many desks can I fit” and more about “what do my members actually pay for here.” For many markets, that means balancing open desks with private offices, plus the meeting and event space that makes the whole site more useful and easier to sell.

Challenges and what operators expect next

Operators said the biggest challenge is still finding and winning members. Many also pointed to high rent and rising costs, and smaller towns were more likely to report financial pressure and weaker local demand. Even so, most operators were optimistic about what comes next.

Which brings us to the next point…

Top challenges for the coworking industry

The coworking industry is booming, but it’s not without challenges:

1. Coworking profitability struggles

One of the biggest challenges for coworking spaces is turning a profit. While demand for flexible workspaces is increasing, many coworking spaces are barely breaking even or losing money. The Global Coworking Survey shows that nearly half of the surveyed coworking spaces struggle to turn a profit, with 18% reporting losses.

Several factors make it difficult for coworking spaces to be financially stable:

- High rent & operating costs: Commercial real estate prices continue to rise in major cities, making it expensive to rent and maintain coworking spaces.

- Energy & utility bills: Keeping the lights on, running high-speed internet, and maintaining common areas can be costly.

- Membership prices: Many coworking spaces hesitate to raise prices for fear of losing members, which limits their ability to cover expenses.

To survive, coworking spaces must find ways to increase revenue without pricing out their customers. This could mean offering additional services like private or virtual offices, event spaces, business support, and wellness programs.

💡 If that sounds like something you might be interested in, here’s our guide to increasing coworking profitability →

2. Competition is heating up

With more coworking spaces opening every year, competition is getting tougher. Big brands like WeWork, Regus, and IWG dominate the market, making it difficult for small, independent coworking spaces to attract members.

Corporate coworking chains have the advantage of scalability — they can offer consistent services, premium office locations, and competitive pricing that smaller spaces may struggle to match. Meanwhile, many landlords are converting vacant office spaces into coworking hubs, increasing competition even further.

To stay competitive, independent coworking spaces need to differentiate themselves by offering unique member experiences, such as:

- Industry-specific coworking (e.g., tech-focused, creative hubs, healthcare coworking spaces).

- Community-driven spaces with networking events, workshops, and mentorship programs.

- Wellness and lifestyle integration include yoga studios, meditation rooms, and on-site cafés.

3. Finding and retaining members

Coworking spaces rely on consistent membership numbers to stay profitable, but attracting and keeping members isn’t always easy. Word of mouth remains the most effective way to gain new members. However, many coworking spaces struggle with member retention, especially in areas with low population density or high competition.

Additionally, the rise of hybrid work models means that some professionals only use coworking spaces part-time, making it harder to predict revenue. Many coworking spaces now offer flexible membership plans (e.g., pay-per-day options, part-time passes, or bundled packages) to adapt to changing work habits.

4. Economic uncertainty and real estate challenges

The coworking industry is closely tied to economic conditions and real estate trends. Coworking spaces will struggle to keep costs low if office space rental prices increase. On the other hand, landlords might convert office buildings into coworking spaces if too many vacant commercial properties flood the market and make competition even tougher.

Additionally, economic downturns can affect businesses’ ability to pay for coworking memberships. Startups, small businesses, and freelancers, a big part of the coworking community, are often the first to cut expenses during financial struggles. This means coworking spaces must balance affordability while staying profitable.

The future of coworking: What’s next in 2026 and beyond

The future of coworking spaces is full of possibilities. Whether they become standardized corporate hubs or unique, community-driven workspaces, one thing is clear: Coworking is here to stay.

Standardization vs. specialization

As coworking spaces grow, experts predict two possible paths for the industry: homogenization or differentiation:

- If large coworking companies like WeWork, Regus, and IWG continue to dominate, coworking spaces may become more corporate and uniform. These spaces will focus on business clients, offering consistent coworking space designs, amenities, and services across locations. While this standardization could make coworking more accessible to big companies, it may reduce variety and flexibility for freelancers and smaller teams who prefer unique, community-driven spaces.

- On the other hand, coworking spaces might become more diverse and specialized, adapting to local needs, industries, and work styles. Independent coworking spaces could grow, offering customized environments for creatives, tech startups, or remote workers. There is a growing trend toward niche coworking spaces that cater to specific industries, such as Med-Tech or fashion, fostering collaboration and networking within specialized sectors.

Coworking spaces as the future of work

Instead of requiring employees to return to a central office, many businesses are choosing coworking spaces as flexible satellite offices. This shift is influencing hybrid work policies, with some companies offering coworking memberships as part of their benefits package.

At the same time, real estate trends will impact the coworking industry. As landlords struggle with vacant office buildings, they may convert traditional office spaces into coworking hubs. This could reduce coworking costs in some areas, making flexible workspaces more accessible. However, if real estate prices remain high, coworking spaces might struggle to stay affordable for freelancers and small businesses.

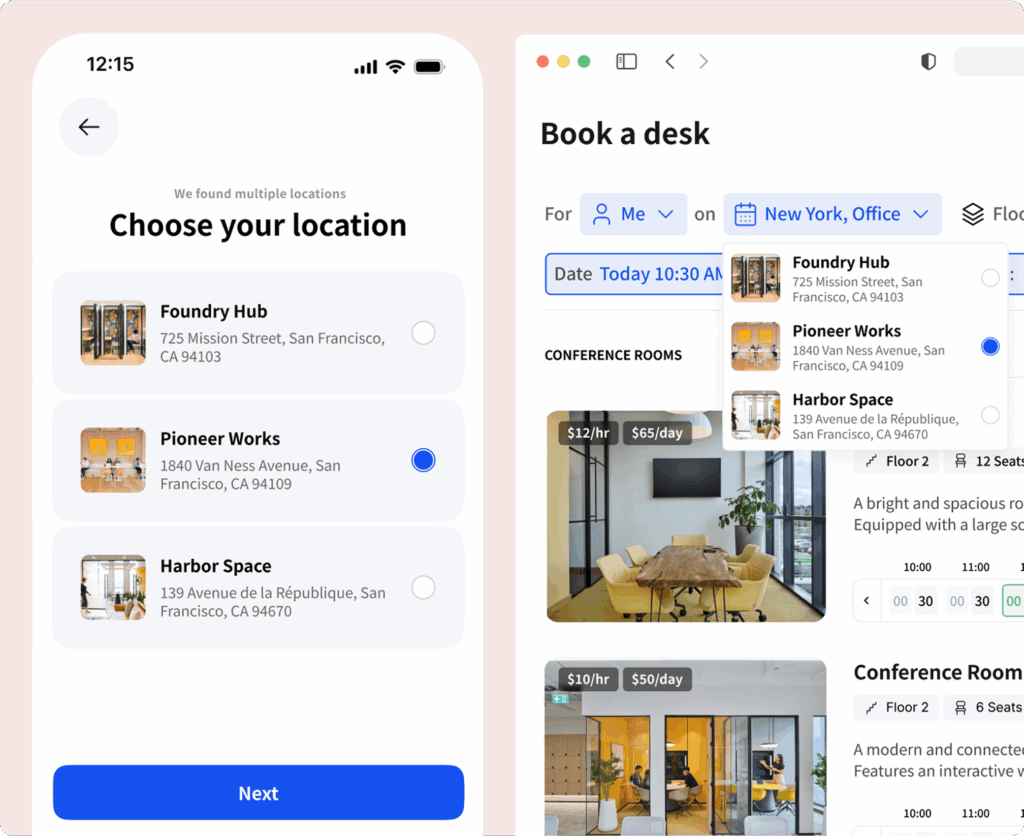

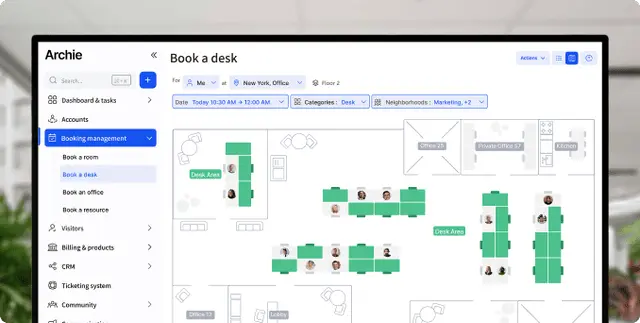

The use of coworking technology

These days, coworking technology is doing way more than just powering the Wi-Fi in shared spaces.

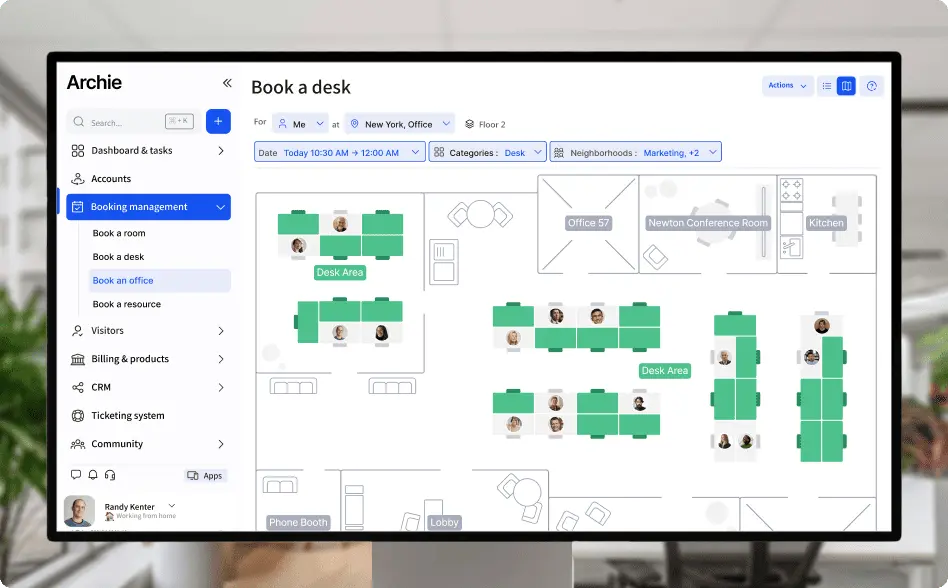

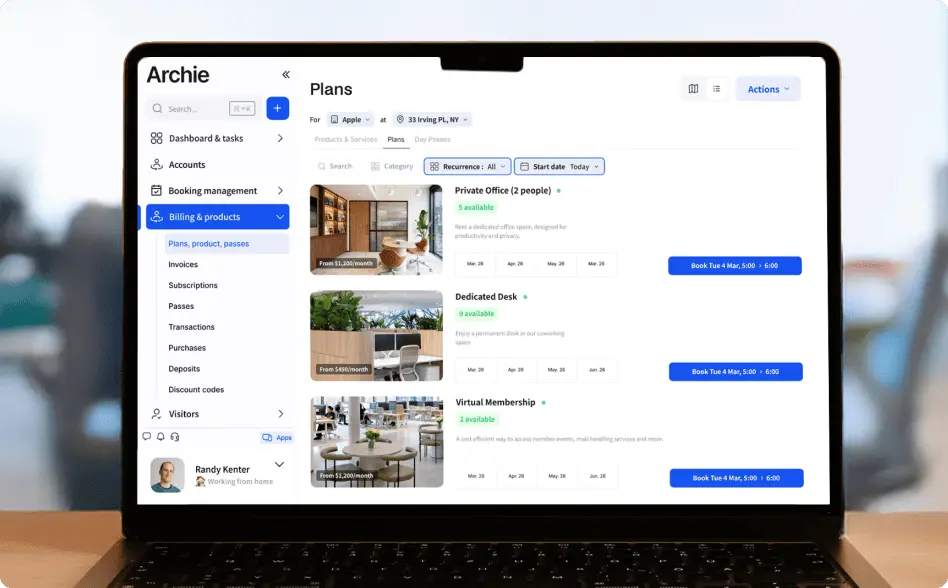

Coworking management software like Archie is helping teams automate things like invoicing, member onboarding, access control, and reporting. Some coworking spaces have saved over 15 hours a week, giving staff more time to focus on members instead of admin.

At the same time, many spaces use AI chatbots to answer questions, schedule tours, and even sell memberships, saving staff time and speeding up response times. AI also helps behind the scenes by studying how people use the space, which has multiple benefits:

Smarter pricing and personalization with AI

Operators are no longer guessing what members want or how much to charge. Instead, they’re using data and AI tools to understand how people actually use the space. This helps them offer more personalized memberships, recommend events people will genuinely enjoy, and even match members with mentors. It’s like giving each person their own tailor-made coworking experience.

One major game-changer is AI-powered pricing. Instead of using static price lists, operators can now adjust prices in real time based on demand. So, when certain desks or rooms are in high demand, prices go up slightly. When things are quieter, prices drop to attract more bookings. According to Flexspace AI, this dynamic pricing model has helped coworking operators boost revenue by over 50%, all without raising prices across the board.

The role of community in coworking spaces

Coworking spaces have always been seen as places for collaboration and networking, but not all spaces automatically create a strong sense of community. In many cases, community managers actively curate interactions, choosing which events, networking opportunities, and social activities to promote. This can be great for some workers but also exclude certain groups or reinforce social divisions.

The challenge for the future is ensuring coworking spaces remain inclusive and accessible to a diverse range of people. If prices continue to rise, coworking could become a luxury reserved for well-paid professionals, leaving out freelancers, early-stage startups, and lower-income workers who also need flexible work environments.

A summary of the most recent coworking statistics

Here are all the key coworking statistics mentioned in the article:

📊 Industry growth and market value

- In 2025, the global coworking and flexible office market is worth around $21 billion.

- Coworking experts predict the market will grow to $82.12 billion by 2034, at a 14.1% annual growth rate.

- Other estimates in the article put the market at $51.42 billion in 2029 and $40.47 billion by 2030, growing at 15.7% per year.

🏢 Number of coworking spaces and footprint

- By the end of 2024, there were about 42,000 coworking spaces worldwide.

- In the US snapshot referenced in the article, coworking reached 8,420 locations.

- The US coworking inventory is described as just over 152 million square feet.

- Coworking is described as only about 2.1% of total US office space.

- The average coworking location is described as around 18,000 square feet.

💸 Pricing benchmarks

- The US national median is described as $225/month for memberships.

- The US national median is described as $30 for day passes.

🧑💼 Coworking users and adoption

- In 2023, corporate teams made up 27.6% of the coworking market.

- A WeWork survey is described as finding that nearly 60% of companies prefer coworking over traditional leases when expanding office space (also shown as 59% in a caption-style line).

🧩 Industry breakdown

- Industries investing most in coworking are listed as: IT and tech (50%), financial services (50%), construction (43%), energy (43%), and business services (30%).

🧑🤝🧑 Coworking demographics

- The average coworking member is around 36 years old.

- Millennials are described as being roughly 27 to 42 years old.

- Millennials are said to make up about 61% of members.

- Women are said to make up nearly half of coworking users.

- Around 80% of members are said to have a college degree.

🌍 Regional market snapshots

- As of Q3 2025, the UK and Ireland are said to have 4,315 coworking spaces in total.

- The UK is said to have 4,048 coworking spaces, and Ireland is said to have 267.

- Greater London is said to have 1,191 coworking spaces.

- Manchester is said to have 120 coworking spaces.

- Glasgow is said to have 68 coworking spaces.

- Birmingham is said to have 67 coworking spaces.

- Dublin is said to have 126 coworking spaces.

- In Germany, “large spaces” are defined as over 500 sqm, and these are said to run at about 75% occupancy.

- In Germany in 2023, 20% of spaces are said to be profitable and 42% are said to break even.

📉 Profitability and performance

- About one in six operators are said to have seen profitability go down.

- Over the last 12 months in the Deskmag survey referenced, 54% of coworking businesses are said to be profitable and 18% are said to report losses.

- In cities with more than 1 million residents, nearly two-thirds are said to be profitable.

- In towns with fewer than 20,000 people, about 1 in 5 are said to be profitable, and about half are said to break even.

- Global average occupancy is said to reach 68% at the start of 2025, and it is said to be well above 70% in major cities.

- About half of operators are said to report high demand for team offices and single-person offices.

📐 Space and layout benchmarks

- A “typical” coworking space is said to have around 90 desks and about 1,200 m².

- Average space per desk is said to be about 14.4 m² per desk (155 ft²).

🧠 Tech and automation in coworking

- Coworking spaces using software are said to save over 15 hours a week in some cases.

- AI-powered dynamic pricing is said to boost revenue by over 50%.

Sources

- Coworking Spaces Market Research Report from Market Research Future

- Coworking Space Global Market Report 2025, The Business Research Company

- Coworking Spaces Market Growth & Trends by Grand View Research

- WeWork Business Leader Survey 2024

- National Report 2024 by CoworkingCafe

- Industry Report Q1 2025 by CoworkingCafe

- UK Flex Market Update Q1 2025 by CBRE

- Asia-Pacific Coworking Space Market Report

- March 2025 Office Market Report by CommercialEdge

- Coworking Price Report 2025 by CoworkingCafe

- U.S. Coworking Industry Report Q2 ’25 by CoworkingCafe

- UK & Ireland Report 2024 by CoworkingCafe

- The German Coworking Market in 2024 by Deskmag

- Global Coworking Survey 2023 by Deskmag

- Working in the comfort zone: Understanding coworking spaces as post-digital, post-work and post-tourist territory by Karin Fast & André Jansson

- Coworking spaces for remote workers: an inclusive solution? Advantages and challenges from affiliated workers’ perspectives by Giuseppina Dell’Aversana & Massimo Miglioretti

- Coworking spaces and workplaces of the future: Critical perspectives on community, context and change by Jennifer Johns, Edward Yates, Greig Charnock, Frederick Harry Pitts, Ödül Bozkurt, Didem Derya Ozdemir Kaya

- The 2025 Coworking Megatrends: A Renaissance in the Making by Liz Elam

- 2025 coworking trends: The year AI infrastructure reshapes everything by Flexspace AI

- 2025’s Coworking Trends: Mid-Year Pulse Check On Earlier Predictions by Coworkies

- U.S. Coworking Industry Report Q3 ’25 by CoworkingCafe

- UK/Ireland Coworking Industry Report Q3 2025 by CoworkingCafe

- 2025 Global Coworking Space Trends by Deskmag

Berenika Teter

Archie's Content Manager, fueled by filter coffee and a love for remote work. When she’s not writing about coworking spaces and hybrid workplaces, you can probably find her exploring one.

![The Latest Coworking Statistics & Industry Trends [2026] A cozy coworking space with wooden walls, warm lighting, and a large map of South America.](https://archieapp.co/blog/wp-content/uploads/2025/08/Latest-coworking-statistics-cover-image.jpg)

![38 Top Coworking Conferences and Events of 2026 [Confirmed] Top coworking conferences - cover image.](https://archieapp.co/blog/wp-content/uploads/2023/10/coworking-400x400.jpeg)